GOVERNANCE

To maximize corporate value, the Group considers it important to establish a highly transparent and efficient management system and continue fair and sound business activities, and accordingly enhance corporate governance, compliance, and risk management, etc.

Corporate governance

Basic concept

With a determination to keep challenging ourselves to create new value, the Group makes an all-out effort to enable our customers to live “the life that they always wanted” and aims to become “a social impact developer” that offers solutions to various social issues and “innovate your lifestyle” through our business. In order to do so, the Group considers it necessary to establish a highly transparent and efficient management system to meet the expectations of shareholders and all other stakeholders as well as improve profitability of the entire group, and therefore is working to enhance corporate governance according to the “Basic Policy on Corporate Governance.”

Basic Policy on Corporate Governance

Corporate governance system

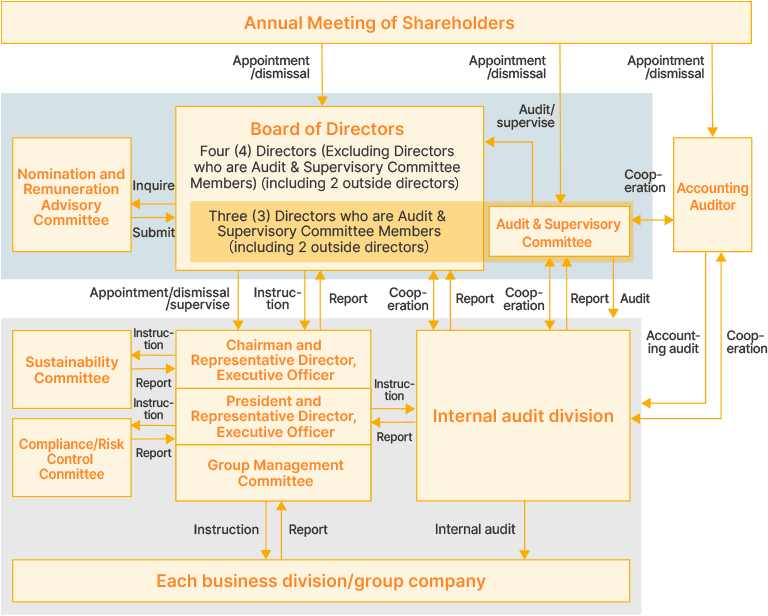

The Group has adopted the following system with an aim to ensure thorough risk management and compliance as well as enhance internal control of the entire Group through supervision/audit of management decisions and its execution while securing a system that allows management to make decisions promptly.

(As of June 21, 2024)

a. Board of Directors

The Board of Directors consists of seven directors (including four outside directors). It holds a regular meeting once a month and extraordinary meetings as needed to decide the Company’s important business management matters as a decision-making body. Furthermore, outside directors are invited to enhance supervisory functions of the Board of Directors and achieve fair and highly transparent management.

b. Audit & Supervisory Committee

The Audit & Supervisory Committee consists of three directors who are Audit & Supervisory Committee members (including two outside directors). It holds a regular meeting on a monthly basis to confirm the operation status of the Board of Directors and the status of execution of duties by directors.

c. Group Management Committee meetings

To ensure efficient execution of duties by directors, the Company and its subsidiaries hold the Group Management Committee meetings regularly, where basic matters regarding business execution are reported and decisions on important matters related to business execution are made in a flexible manner.

d. Compliance and Risk Management Committee

To ensure thorough risk management and compliance with laws and regulations and the Articles of Incorporation in the entire Group, the Company holds the Compliance/Risk Control Committee meetings regularly and receives reports from division managers on respective business to understand issues and implement necessary measures.

e. Sustainability Committee

To promote the sustainability strategy, the Company holds the Sustainability Committee regularly and receives reports from division managers on the progress of sustainability initiatives to review the progress status, discuss the implementation policy, and monitor the initiatives.

f. Nomination and Remuneration Advisory Committee

The Company has established the voluntary “Nomination and Remuneration Advisory Committee” as an advisory body to the Board of Directors with an aim to further enhance corporate governance through enhancement of independence and objectivity of the Board of Directors’ functions related to nomination and remuneration, etc. of directors.

Members of each body are as follows.

⇔scroll

| Title | Name | Board of Directors | Audit & Supervisory Committee | Group Management Committee | Compliance/Risk Control Committee | Sustainability Committee | Nomination and Remuneration Advisory Committee |

|---|---|---|---|---|---|---|---|

| Chairman and Representative Director, Executive Officer | Tetsuya Hirooka | ◎ | ◎ | ○ | ◎ | ○ | |

| President and Representative Director, Executive Officer | Eiichi Ogawa | ○ | ○ | ◎ | ○ | ||

| Outside Director (Independent) |

Masatoshi An | ○ | ◎ | ||||

| Outside Director (Independent) |

Shoji Tsuboyama | ○ | |||||

| Director, Audit & Supervisory Committee Member | Atsuhiro Imai | ○ | ◎ | ○ | ○ | ○ | |

| Outside Director, Audit & Supervisory Committee Member (Independent) |

Naoko Taniguchi | ○ | ○ | ||||

| Outside Director, Audit & Supervisory Committee Member (Independent) |

Shinkichi Matsuo | ○ | ○ | ○ |

*◎ indicates a chairperson and ○ indicates a member

* Directors of major subsidiaries and representatives of each division and office participate in the Group Management Committee and Compliance/Risk Control Committee, in addition to the above members.

Independent officers

The Company designates all outside directors who satisfy the criteria for independent officers as independent officers. Outside directors are considered to be independent only if they do not fall under any of the independence criteria specified by the Financial Instruments Exchange as well as the following items.

Independence criteria for independent officers

⇔scroll

| Name | Title | Reason for appointment | Main activities |

|---|---|---|---|

| Masatoshi An | Outside Director | Masatoshi An served as Representative Director of Nikken Sekkei Ltd. for many years, and has extensive experience in corporate management and wide-ranging insight in the fields of architectural design, urban planning, and redevelopment projects. The Company has therefore nominated him as a candidate for Outside Director. After his election, we expect that he will provide opinions on the Company’s overall management and, in particular, that he will supervise the Company’s management from an independent standpoint by providing advice based on his wide-ranging insight in the fields of quality control, urban planning and redevelopment projects. If he is elected, he will be involved as a member of the Nominating and Remuneration Advisory Committee from an objective and neutral standpoint in the selection of candidates for the Company’s officers and in the determination of the officer remuneration. | He attended all 13 meetings of the Board of Directors held in FY2023 and made recommendations on agendas, etc. based on his insight. In particular, we expect he will use his insight in the fields of architectural design, urban planning, and redevelopment projects to supervise management. He provides valuable advice on the Company’s business policy decisions and quality control at the Board of Directors meetings. He is also a member of the Nomination and Remuneration Advisory Committee. |

| Shoji Tsuboyama | Outside Director | The reason for his appointment as an outside director is that he has extensive experience and wide-ranging insight in corporate management and in the financial and securities industries. The Company has therefore nominated him as a candidate for Outside Director. We expect that he will provide opinions on overall management and, in particular, advice on finance, accounting and capital strategy, and supervise the Company’s management from an independent standpoint. | He attended all 13 meetings of the Board of Directors held in FY2023 and made recommendations on agendas, etc. based on his insight. In particular, we expect he will use his wide-ranging insight in various aspects of the financial sector to supervise management. He provides valuable advice on the Company’s capital policy and IR strategy at the Board of Directors meetings. |

| Naoko Taniguchi | Outside Director,Audit & Supervisory Committee Member | Naoko Taniguchi has a high level of knowledge in corporate governance, risk management, and overall corporate legal affairs, which she has cultivated through her many years of experience as an attorney at law of the U.S. state of New York. We nominated her as a candidate for Outside Director who is an Audit & Supervisory Committee Member in the expectation that she will audit the Company’s management from an objective and neutral standpoint and make timely and appropriate comments at meetings of the Board of Directors and the Audit & Supervisory Committee. After her appointment, we expect that Ms. Taniguchi will supervise management of the Company from an independent standpoint through her advice on risk management, personnel systems in general, and corporate governance. | - |

| Shinkichi Matsuo | Outside Director,Audit & Supervisory Committee Member | Shinkichi Matsuo has been engaged for many years in accounting audits as a certified public accountant, and has extensive experience and wide-ranging knowledge in the fields of corporate accounting and auditing. We nominated him as a candidate for Outside Director who is an Audit & Supervisory Committee Member in the expectation that he will utilize his expertise and insight also as a real estate appraiser to audit the Company’s management from an objective and neutral standpoint and make timely and appropriate comments at meetings of the Board of Directors and Audit & Supervisory Committee. After his appointment, we expect Mr. Matsuo will supervise management of the Company from an independent standpoint through his advice on corporate governance, risk management, and financial accounting. | - |

Assessment of the effectiveness of the Board of Directors

(As of June 21, 2024)

The Company analyzes and assesses the effectiveness of the Board of Directors every year to further improve its functions. The summary of the assessment of the Board of Directors’ effectiveness and its result are as follows.

(1) Assessment method

The Company conducted a survey of all directors and auditors about the effectiveness of the Board of Directors and used the results for the analysis and assessment at the Board of Directors meeting held on June 13, 2024

(2) Assessment items

- System of the Board of Directors (number, composition, expertise, and diversity, etc.)

- Operating status of the Board of Directors (meeting frequency, information provision, Q&As, supervisory function, and improvement points, etc.)

(3) Assessment result and future measures

It was confirmed that the Board of Directors’ effectiveness is ensured in terms of sustainable enhancement of the Group’s corporate value. We will strive to further enhance functions of the Board of Directors using the assessment result.

Directors’ remuneration plan

(As of June 21, 2024)

The amounts of remuneration of the Company’s directors are determined taking into comprehensive consideration their duties, business performance of the relevant fiscal year, and the degree of contribution, etc. as described below.

(1) Basic policy for directors’ remuneration plan

The Group presents the following basic policy for directors’ remuneration plan that allows directors to contribute to the realization of sustainable growth and enhancement of corporate value over the medium- to long-term, and enables directors to take on the challenges of future growth of the Company while sharing values with stakeholders.

① Levels that can secure and maintain the necessary human resources to improve corporate value

② Contribute to sharing profit awareness with shareholders and management with an emphasis on shareholders

③ Strongly linked to medium- to long-term performance improvement

④ A Compensation decision process that is rational, fair, and transparent

(2) View on the remuneration levels

The Group is engaged in (i) real estate development business, (ii) CCRC business, (iii) real estate investment business, and (iv) condominium management and related services business to take on the challenges of future growth. The Company establishes appropriate remuneration levels to secure and maintain necessary human resources to further improve corporate value and contribute to solving social issues through our businesses by speeding up decision-making and improving management efficiency by strengthening group governance. Specifically, we utilize an external remuneration consultant and setting directors’ remuneration levels of similar industries (condominium development, real estate investment, etc.) as benchmarks.

(3) View on the remuneration structure

The remuneration for directors (excluding Audit & Supervisory Committee members and outside directors) at Hoosiers Holdings Co., Ltd. is comprised of fixed monthly base remuneration, annual performance bonus as short-term incentive remuneration, and stock compensation as medium- to long-term incentive remuneration (Board Benefit Trust)*1. Taking into account the corporate scale and business characteristics of the Group, annual performance bonus and stock compensation account for approximately 20% and 10% of the total remuneration, respectively*2. The remuneration of Audit & Supervisory Committee members (excluding outside directors) and outside directors shall consist only of base remuneration to appropriately supervise executive persons.

*1 This plan is a performance-linked stock-based compensation system wherein the Company contributes money to a trust, and the trust acquires the shares of the Company using the money as a source of funds. The Company and its eligible subsidiaries provide directors of the Company, etc. through the trust with the Company’s shares and an amount of money equivalent to the market value of the Company’s shares (“the Company’s Shares, etc.”) according to the performance achievement rate, etc. in accordance with the Share Delivery Regulations. As a general rule, Directors of the Company, etc. will receive the Company’s Shares, etc. when they retire.

*2 The above composition ratios are percentages when a variable remuneration of 100% of the standard amount set by the Company is paid.

■Basic structure of directors’ remuneration

| Fixed remuneration | Variable remuneration(short-term) | Variable remuneration(medium-to long-term) | |

|---|---|---|---|

| Basic remuneration (money) |

Annual performance bonus (money) |

Performance-linked stock compensation (shares/money in part) |

|

| Directors (excluding Audit & Supervisory Committee members and outside directors) | 70% | 20% | 10% |

| Audit & Supervisory Committee members (excluding outside directors) | 100% | - | - |

| Outside directors | 100% | - | - |

■Evaluation criteria

① Annual performance bonus: “Growth rate in consolidated operating income,” “Financial soundness,” and “Group ESG initiatives” are evaluated to provide incentives for performance and sustainability over the medium- to long-term as well as the short term. The evaluation ratio and target value for each assessed item shall be decided by the Board of Directors every year after deliberation by the Nomination and Remuneration Advisory Committee.

② Stock compensation: From the perspective of shared interests with shareholders, performance indicators in the Medium-Term Management Plan are set as the base. The “Consolidated ordinary income” target disclosed in the Medium-Term Management Plan and the “ROE” target specified in the business plan are assessed at ratios of 50% each, with the performance-linked coefficient range between 0 to 2. (Set at 2 if the target achievement rate is 120% or higher and at 0 if less than 80%)

| Target achievement rate | Performance-linked coefficient |

|---|---|

| 120% or higher | 2 |

| 80% or higher but less than 120% | (Achievement rate-80%)×5 |

| Less than 80% | 0 |

| Indicator | Target value | Evaluation ratio |

|---|---|---|

| Consolidated ordinary income | Value for each year disclosed in the Medium-Term Management Plan | 50% |

| ROE | Value for business performance forecasts set in the Medium-Term Management Plan and announced at the beginning of each fiscal year | 50% |

Target achievement rate: Performance achievement rate of consolidated ordinary income x evaluation ratio + performance achievement rate of ROE x evaluation ratio

(4) Remuneration decision process

The Company has established the discretionary Nomination and Remuneration Advisory Committee as an advisory body to the Board of Directors for the purpose of strengthening the independence and objectivity of the functions of the Board of Directors regarding the nomination and remuneration of directors and to further enhance corporate governance. The remuneration of directors is decided by the Board of Directors based on the report from the Nomination and Remuneration Advisory Committee.

With respect to the directors’ remuneration for the fiscal year ending March 31, 2025, the policy and the directors’ remuneration were deliberated by the Nomination and Remuneration Advisory Committee on June 4, 2024

and resolved by the Board of Directors on June 21, 2024.

During the fiscal year ended March 31, 2024, the Nomination and Remuneration Advisory Committee meetings were held four times, at which the members deliberated on officer system and directors’ remuneration for the fiscal year ending March 31, 2025 (decision on the payment of annual performance bonus and performance-linked stock-based remuneration for the fiscal year ended March 31, 2024 and decision on base remuneration for the fiscal year ending March 31, 2025).

(5) Engagement policy

The content of the Company’s directors’ remuneration plan is promptly disclosed to the Company’s shareholders through means such as the Annual Securities Report, Business Report, Corporate Governance Report, Sustainability Report, and the Company’s website, prepared and disclosed in accordance with applicable laws and regulations.

*Resolutions on directors’ remuneration, etc. at the Annual General Meeting of Shareholders

At the Annual General Meeting of Shareholders held on June 24, 2022, it was resolved that the maximum amount of annual remuneration to be paid to the Company’s directors (excluding those who are Audit & Supervisory Committee members) shall be 300 million yen. In addition to this, it was also resolved at the Meeting that the applicable terms for the performance-linked stock compensation to be paid to directors (excluding directors who are Audit & Supervisory Committee members and outside directors) shall be the four-year period from the fiscal year ending March 31, 2023 to the fiscal year ending March 31, 2026 and each five-year period thereafter (as a rule, the period corresponding to the Medium-Term Management Plan) and that the maximum amount of remuneration shall be 180 million yen. At the Annual General Meeting of Shareholders held on June 24, 2022, it was also resolved that the maximum amount of annual remuneration to be paid to directors who are Audit & Supervisory Committee members shall be 100 million yen.

*Total remuneration, total amount by remuneration type and number of eligible officers by officer category for the fiscal year ended March 31 2024

⇔scroll

| Officer category | Total remuneration (million yen) |

Total amount by remuneration type (million yen) |

Number of eligible officers (persons) | ||

|---|---|---|---|---|---|

| Base remuneration (money) | Annual performance bonus (money) | Performance-linked stock-based remuneration , etc. (shares/ money in part) |

|||

| Directors (excluding Audit & Supervisory Committee members and outside directors) | 103 | 71 | 18 | 13 | 3 |

| Audit & Supervisory Committee members (excluding outside directors) | 14 | 14 | ― | ― | 1 |

| Outside officers | 29 | 29 | ― | ― | 5 |

(Note) The Company transitioned from a Company with a Board of Auditors to a Company with an Audit & Supervisory Committee on June 24, 2022.

Basic policy on internal control system

Basic policy on internal control system

Compliance

Basic concept

The Group’s basic stance is to always comply with relevant laws and regulations and internal rules including the Hoosiers Group Action Guidelines in every aspect of corporate activities, and we ensure that our corporate activities conform to normal commercial practice and social ethics.

Hoosiers Group Action Guidelines

The Group has developed “Hoosiers Group Action Guidelines (“Guidelines”)” to set out basic rules to be observed by the Group’s officers and employees. The effectiveness of the “Guidelines” will be reviewed as needed in consideration of social and other conditions, with any revisions to be resolved by the Board of Directors.

Whistleblower system

The Group provides consultation for or receive reports on compliance violations, etc. such as illegal acts or harassment at workplace. We handle matters brought to our attention carefully to prevent those who consulted/reported from being subject to unfair treatment and strive to enhance compliance management by early detecting and correcting illegal acts, etc.

Compliance promotion system

The Company and its subsidiaries have the Compliance/Risk Management Rules to ensure that execution of duties by directors and employees complies with laws and regulations and the Articles of Incorporation. The Compliance/Risk Control Committee, chaired by President and Representative Director, Executive Officer and comprised of directors and our subsidiaries’ presidents, etc. holds meetings regularly and receives reports from division managers on respective businesses to understand issues and implement necessary measures.

Compliance and enlightenment

The Group provides compliance trainings targeted at all employees, including new and mid-career employees, on a regular basis to promote compliance and bring enlightenment.

| Name | Frequency/Persons subject to training |

|---|---|

| Compliance training for all employees | Provided to all employees once a year in principle |

| Monthly compliance training for all employees | Provided to all employees once a month in principle |

| Compliance training for new employees | Provided to all new employees once a year |

| Training for new employees on the Building Lots and Buildings Transaction Business Act | Provided to all new employees once a year |

| Compliance training for mid-career employees | Provided to mid-career employees as needed |

| Compliance training for new managers | Provided to new managers once a year |

Fair competition and fair transaction

The Group has set a policy about relationship with customers, business partners, and peers, etc. including “fair transaction” and “free competition” in the “Action Guidelines” to ensure compliance with the Antimonopoly Act and the Subcontract Act.

Policy on political involvement

The Group complies with the Political Funds Control Act and the Public Offices Election Act, etc. for political fund/donation, election, and political activities and keeps politically correct attitude.

Guidelines for social media

The Group continues to raise awareness through compliance trainings, etc. for precautions against and risks associated with the use of SNS to send information within and outside the company.

Policy on prevention of bribery and corruption

The Group prohibits entertainment and gifts for business partners that are beyond the bounds of social common sense and entertainment for public officials that is deemed as provision of benefits for the purpose of obtaining illicit profits. Specifically, the “Action Guidelines” stipulates as a policy on entertainment and gifts that “all employees shall follow sound business practice according to social common sense in offering/accepting entertainment or gifts to/from business partners.” As for the policy on entertainment and gifts for public officials, the “Action Guidelines” prohibits “bribery of members of the Diet, the head and assembly members of local governments and officers and employees of governmental agencies and local governments (including those regarded as quasi-public servants who are officers and employees of corporations of associations) as well as entertainment, gift-giving and other dealing without reasonable grounds, that are deemed as provision of benefits for the purpose of obtaining illicit profits.”

Response to antisocial forces

The Group has set a policy to take a firm attitude to antisocial forces in the “Action Guidelines” and ensures that the Group’s directors and employees are aware of it. In terms of the internal system, with the legal division as the responsible division, we have thoroughly implemented measures to eliminate antisocial forces by including “clauses for the elimination of antisocial forces” in all contracts or requesting business partners, etc. to submit a “written confirmation.” In case of an incident such as undue claims from antisocial forces, we set up a system to deal with it in cooperation with lawyers, competent police station, and other relevant agencies and also collect information.

Risk management

Basic concept

The Group aims for management that achieves sustainable growth, maximizes its corporate value and solves social issues through its business activities while recognizing the business environment surrounding the Company and managing risks within its risk tolerance.

Risk management system

The Group manages the company-wide risk comprehensively by establishing the Compliance/Risk Management Rules and positioning the Compliance/Risk Control Committee as a centralized and cross-organizational body to manage risks of all divisions and group companies.

In the Compliance/Risk Management Rules, risks that the Group should manage are classified into the following four types.

- Disaster risk: Disaster-induced risk that has a significant impact on customers, business continuity, etc.

- External risk: Risk associated with external factors that has an impact on business operations

- Investment risk: Risk associated with individual investments

- Internal risk: Operational risk arising within the Group

The Compliance/Risk Control Committee exhaustively identifies risks of all divisions and group companies based on the above classification taking into consideration changes in internal and external environment. The Committee analyzes the identified risks for the degree of impact (severity) and the probability of occurrence and recognizes risks of high importance and priority as “major risks.” The Committee also assesses and analyzes the major risks through regular monitoring to determine the response policy and give necessary instructions and advice for relevant divisions and group companies to implement response measures. Matters discussed and determined at the Compliance/Risk Control Committee are reported to the Board of Directors on a regular basis.

Major risks

The Group considers the following 10 items as major risks that might have material impacts on its consolidated financial position, operating results, and cash flows and is taking measures to address them.

Disaster risk

- Natural disaster risk

External risk

- Climate change risk

- Market interest rate fluctuation risk

- Risk related to talent acquisition

Investment risk

- Risk related to acquisition of land for development

- Risk of increasing development costs

- Risk of asset deterioration

Internal risk

- Legal risk

- Risk related to product/service quality management

- Risk of fraud and negligence by officers and employees

Development and Implementation of Business Continuity Plan (BCP) in the Event of an Emergency

The Group has been working on the development of a “Business Continuity Plan (BCP)” to ensure that critical operations will not be disrupted by disasters or accidents and to enable a swift recovery in the face of disruption and established the “Hoosiers Group Initial Response and Business Continuity Plan” in September 2023. In accordance with the Plan, we conduct an annual “Disaster Drill” organized by the Emergency Response Headquarters, headed by the General Manager of the Management Headquarters. The drill aims to confirm the initial response outlined in the Business Continuity Plan (BCP), including Code of Conduct, safety confirmation and reporting of officers and employees, and roles of the Response Headquarters members, to prepare for emergencies such as earthquakes. In addition to this plan for the entire Group, we also began the process of developing a Business Continuity Plan (BCP) for each group company. We will continue our efforts to improve the quality and effectiveness of these plans and fulfill our corporate social responsibility.

Respect for human rights

Basic concept

The Group respects basic human rights of all people in any aspect of corporate activities. Also, we do not tolerate any form of discrimination based on race, belief, ideas, gender, age, social status, occupation, family origin, nationality, ethnicity, religion or disability, etc. or behavior that will impair human dignity.

Personal information protection policy

Recognizing that protection and proper management of personal information is an important social obligation, the Group respects and complies with laws and regulations and social norms on protection of personal information and ensures to properly handle and protect personal information in accordance with relevant rules including “the Personal Information Protection Rule.”

Harassment prevention trainings

The Group provides harassment prevention trainings regularly as part of its compliance trainings to prevent harassment including sexual harassment and workplace bullying.

Response to human rights issues

The Group provides a compliance consulting service that takes necessary actions for consultation such as on human rights abuses or harassment, etc. while respecting opinions of those seeking advice and giving due considerations not to create disadvantages to them.

Supply chain initiatives

Basic concept

The Group cooperates with various suppliers in its mainstay Real Estate Development from acquisition of land to sales and management. In light of these business characteristics, we consider it necessary to work together with the entire supply chain to carry out environmental initiatives and contribute to revitalization and development of society, and accordingly developed “Hoosiers Group CSR Procurement Guidelines.”

Hoosiers Group CSR Procurement Guidelines

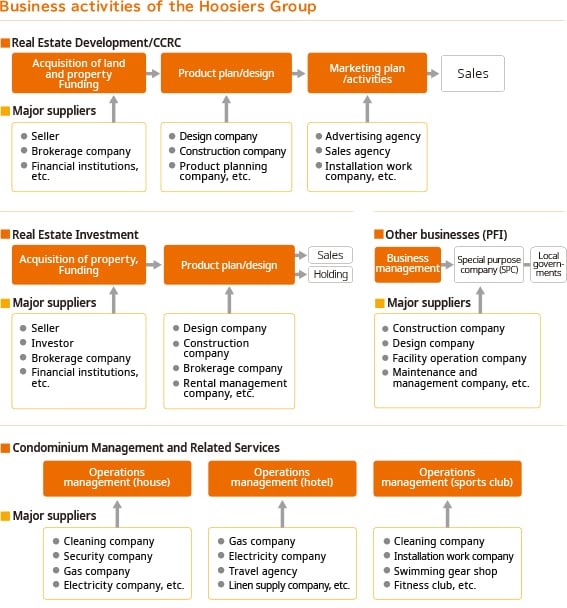

Business activities of the Hoosiers Group